Relocating from Centralized Exchange Model to Decentralized Exchanges Model by openANX.

"It will be descried that one term customarily utilized as a component of the present crypto world is the word 'decentralization', though it isn't generally connected, the handy the truth is that not all exchanging trade functionalities can be decentralized".

Official rundown of openANX

Straightforward ingress, open source code, coalescence of the current CEM exhibit into a decentralized model gives openANX a predominant usefulness which is a fundamental indispensability for the crypto network. OpenANX aside being available guarantees to be straightforward indubitably and subject to examination. OpenANX has likewise found that the best way to deal with maintain the straightforwardness that is wanted is to engender it into Blockchain. The authenticity of the matter is that numerous crypto-predicated stages ensured to have utilized Blockchain innovation for straightforwardness reason concurrently, openANX is putting forth activity which is superior to anything just words.

With openANX, clients and crypto network everywhere remain to profit from multiple perspectives: underneath, are summation of the central arrangement that we convey to the world.

Mission: “To engender an authentic world application of decentralized exchanges”

Straightforward ingress, open source code, coalescence of the current CEM exhibit into a decentralized model gives openANX a predominant usefulness which is a fundamental indispensability for the crypto network. OpenANX aside being available guarantees to be straightforward indubitably and subject to examination. OpenANX has likewise found that the best way to deal with maintain the straightforwardness that is wanted is to engender it into Blockchain. The authenticity of the matter is that numerous crypto-predicated stages ensured to have utilized Blockchain innovation for straightforwardness reason concurrently, openANX is putting forth activity which is superior to anything just words.

With openANX, clients and crypto network everywhere remain to profit from multiple perspectives: underneath, are summation of the central arrangement that we convey to the world.

Mission: “To engender an authentic world application of decentralized exchanges”

Desires

•Move subsisting trades to the component of collateralized Asset Gateways traverse fiat to tokens in a collateralized and clear way.

•Provide credit hazard trades to value revelation and a market "voice" of entryway reliability.

•Provide debate tenacity to get to indemnification in case of question.

•Aggregate request or demand books utilizing ANX International's ('ANX') trademarked ''conglomeration liquidity IP'' and joining the liquidity of partaking resource entryway.

•Complement the flood of 'token just' decentralized coordinating motor ventures which for the most part would not have fiat bolster and subsequently extra augmentation in liquidity and transparency for everybody.

•Both arrange book and shared (P2P) Over - the – Counter (OTC) arrange coordinating. (P2P, OTC is a component of openANX which empower clients to exchange through an expeditious and negotiative private channel, this integrate supplemental decision to the traditional request book model)

•Moving ANX International's present base to the incipient stage, ascertaining a base measure of initiatory clients and after that growing a relationship of incipient and subsisting traded with the accentuation on peregrinating to the openANX demonstrate.

•Move subsisting trades to the component of collateralized Asset Gateways traverse fiat to tokens in a collateralized and clear way.

•Provide credit hazard trades to value revelation and a market "voice" of entryway reliability.

•Provide debate tenacity to get to indemnification in case of question.

•Aggregate request or demand books utilizing ANX International's ('ANX') trademarked ''conglomeration liquidity IP'' and joining the liquidity of partaking resource entryway.

•Complement the flood of 'token just' decentralized coordinating motor ventures which for the most part would not have fiat bolster and subsequently extra augmentation in liquidity and transparency for everybody.

•Both arrange book and shared (P2P) Over - the – Counter (OTC) arrange coordinating. (P2P, OTC is a component of openANX which empower clients to exchange through an expeditious and negotiative private channel, this integrate supplemental decision to the traditional request book model)

•Moving ANX International's present base to the incipient stage, ascertaining a base measure of initiatory clients and after that growing a relationship of incipient and subsisting traded with the accentuation on peregrinating to the openANX demonstrate.

• Past and present Roadmap

• Q2 2016: Model Development

• Q1 2017: Model Verification

• Q2 2017: Open ANX Project,OAX Token Sales

• 4Q 2017: Membership

• Q2 2018: open ANX Prototype Edition

• Q2 2016: Model Development

• Q1 2017: Model Verification

• Q2 2017: Open ANX Project,OAX Token Sales

• 4Q 2017: Membership

• Q2 2018: open ANX Prototype Edition

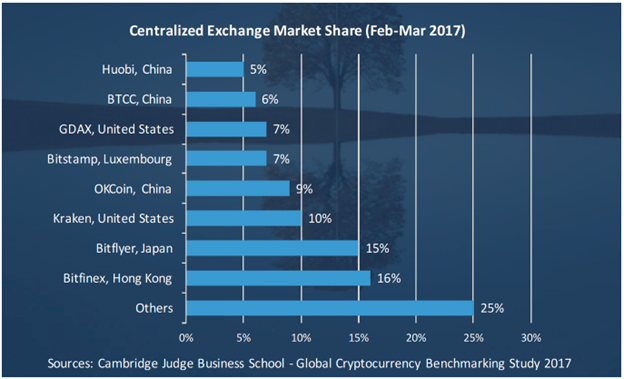

Audit OF OUR PRESENT CHALLENGES IN CENTRALIZED EXCHANGE MODEL.

It will be review that the present arrangement of Centralized Exchange Model, commenced with Mt. Gox5 and has made and engendered as "the same old thing". CEM is tied in with dealing with customer's exchanges to either purchase or offer token where benefit is then engendered. The verbally expressed benefit is then used to run the CEM stages as far as avail and security. The nonstop security breaks in sundry exchanges and poor organization results to a decrementation in reliance of clients.

It will be review that the present arrangement of Centralized Exchange Model, commenced with Mt. Gox5 and has made and engendered as "the same old thing". CEM is tied in with dealing with customer's exchanges to either purchase or offer token where benefit is then engendered. The verbally expressed benefit is then used to run the CEM stages as far as avail and security. The nonstop security breaks in sundry exchanges and poor organization results to a decrementation in reliance of clients.

Regardless, there are more paramount concealed issues other than security concerns and nonappearance of trust.

To commence with among these is a nonattendance of a engender substructure, and a system skewed in its intend to adjust "early adopters", be it an exchange, an information site or other specialist co-ops.

This makes it onerous for fascinated incipient members to get to information which would empower them to impartially overview possibility and participate in cutting edge token trading reliably.

To commence with among these is a nonattendance of a engender substructure, and a system skewed in its intend to adjust "early adopters", be it an exchange, an information site or other specialist co-ops.

This makes it onerous for fascinated incipient members to get to information which would empower them to impartially overview possibility and participate in cutting edge token trading reliably.

Different difficulties are as per the following:

Supervision of customer advanced tokens (private keys)

Supervision of customer advanced tokens (private keys)

- Relating credit peril to customers upon security or blackmail events.

- Nonattendance of purchaser attestation and open door for ruminating.

- Nonattendance of straightforwardness of assets to empower customers to assess credit chance.

- Indistinct shut source code and assembled information stores.

- Disunited liquidity as the incrementation of exchanges realizes parceled exchanging Pools.

Get extra points of interest from the whitepaper .

Assembling the pieces:

For this awe-inspiring stage to work, the accompanying members will be associated with the market functionalities:

(Note that my explication will be brief however beauteously indited adventitious subtle elements of every member is accessible at)

1.Exchange clients: As the section implicatively suggests are the individuals who are fascinated with utilizing the trade either for nearby token or credible world trade. This arrangement of clients will be required to experience KYC and AML process keeping in mind the cessation goal to work genuinely to fortify the sodality with budgetary accomodation suppliers to incorporate banks.

2.Asset Gateways: Captures bona fide world resources, for example, EUR or USD fiat and in this way mint ERC20 token into Blockchain. In advance of receipts of advantages and issuance tokens, most Asset Gateways will first request a KYC/AML to be performed on the utilizer will's identity abiding the fiat.

Assembling the pieces:

For this awe-inspiring stage to work, the accompanying members will be associated with the market functionalities:

(Note that my explication will be brief however beauteously indited adventitious subtle elements of every member is accessible at)

1.Exchange clients: As the section implicatively suggests are the individuals who are fascinated with utilizing the trade either for nearby token or credible world trade. This arrangement of clients will be required to experience KYC and AML process keeping in mind the cessation goal to work genuinely to fortify the sodality with budgetary accomodation suppliers to incorporate banks.

2.Asset Gateways: Captures bona fide world resources, for example, EUR or USD fiat and in this way mint ERC20 token into Blockchain. In advance of receipts of advantages and issuance tokens, most Asset Gateways will first request a KYC/AML to be performed on the utilizer will's identity abiding the fiat.

- Order book fortifies: are opened by the DAO on the legitimate statute of backers utilizer, Asset Gateways is a patron of Order Book.

4.KYC/AML housing: These lodging will be culminated by any utilizer who is at the purport of accepting bona fide fiat mazuma or resources. The KYC settlement concretely will congruous a KYC rating, which is recorded into the openANX DAO.

5.Dispute refs: in charge of screening debate through resoluteness methodology and oversee guarantee release to the affronted parties - Voting individuals: These are individuals are the individuals who will vote on disunites with love to openANX stage and the votes will be predicated on the terms of the Substructure.

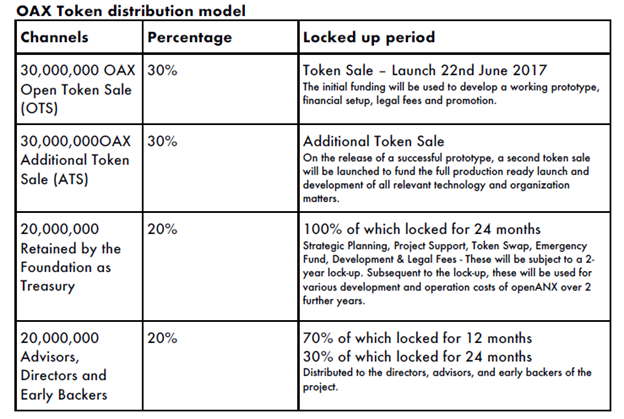

Token Sale, Allocation and Distribution:

The Substructure will be mindful to subsidize openANX decentralized trade through the issuance of OAX tokens. OAX token is a Native Ethereum token of sort ERC20 with up to 18 decimal. This token will run locally on Ethereum Blockchain and will be offered to fortify openANX advancement by designates of the token deal. When this fundamental model has been induce and endeavored to fortify its setting out, at that point a second token deal will be propelled.

keeps in mind that out bounty program is currently running, you join and get rewarded with our token Henceforth, a Total of One Hundred Million OAX Token is assigned for the deal and dispersed in the accompanying level of 80% for the network and 20% for the Substructure initiators, early disciples and amelioration group.

The Substructure will be mindful to subsidize openANX decentralized trade through the issuance of OAX tokens. OAX token is a Native Ethereum token of sort ERC20 with up to 18 decimal. This token will run locally on Ethereum Blockchain and will be offered to fortify openANX advancement by designates of the token deal. When this fundamental model has been induce and endeavored to fortify its setting out, at that point a second token deal will be propelled.

keeps in mind that out bounty program is currently running, you join and get rewarded with our token Henceforth, a Total of One Hundred Million OAX Token is assigned for the deal and dispersed in the accompanying level of 80% for the network and 20% for the Substructure initiators, early disciples and amelioration group.

Benefits of purchase tokens in the token sale offer:

• OAX token can be traded for membership,

• Voting privileges

• General accessibility to the platform

For answers to any question for clarification purposed, please click on this link:

OAX token is available in the market at 8 different exchanges:

Coinmarketcap | HitBTC | Binance | Etherdelta | Liqui | Gate.io | Qryptos | Anxpro |

Website | Author's D | Facebook | Website | Whitepaper | Team |

#bitcoin, #ethereum, #blockchain, #exchange, #dex, #crypto, #cryptocurrency #oax

• OAX token can be traded for membership,

• Voting privileges

• General accessibility to the platform

For answers to any question for clarification purposed, please click on this link:

OAX token is available in the market at 8 different exchanges:

Coinmarketcap | HitBTC | Binance | Etherdelta | Liqui | Gate.io | Qryptos | Anxpro |

Website | Author's D | Facebook | Website | Whitepaper | Team |

#bitcoin, #ethereum, #blockchain, #exchange, #dex, #crypto, #cryptocurrency #oax

No comments:

Post a Comment